Check the box that says, ‘please confirm your secure access message’. This will be your PAN, AADHAR, or any other ID you used at the time of registration. In the login screen, enter your login details.

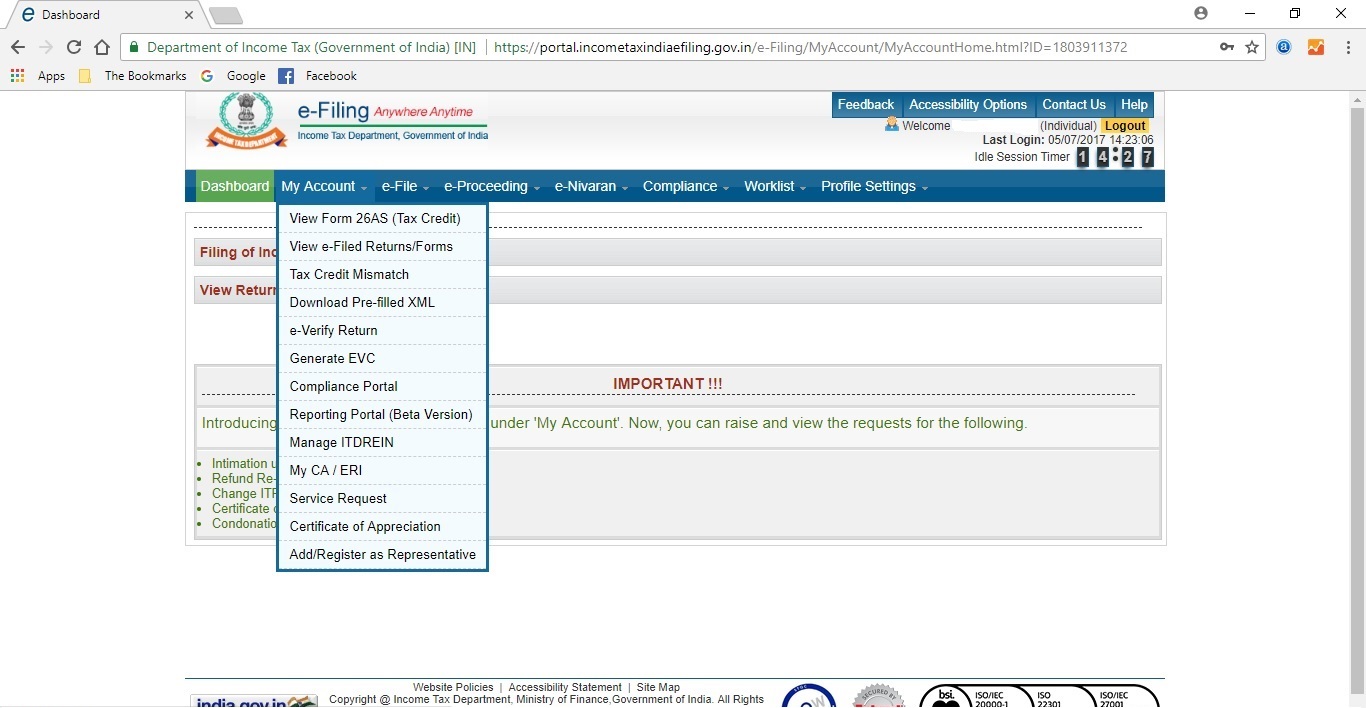

Will the application and secure your account? If you are already registered you can skip this step.ģ. In the registration menu, enter your PAN number and move forward. This is located in the top-right corner of the website.Ģ. Through Income Tax e-filing How to Download Form 26AS From Traces?ĭownload Form 26AS by performing the following steps:ġ. The Form 26AS can be downloaded in three ways.

This one form thus helps you identify various details regarding your income-tax and supports you in filing returns. You need to download Form 26AS as it is a consolidated statement that shows you information about TDS and TCS and also about the settlement of refunds. By registering on this website, you can view the taxes paid and also reconcile them.įorms 16, 16A and 26AS can be downloaded easily from this website. TRACES help both the tax deductors and tax-payers. TDS Reconciliation Analysis and Correction Enabling System or TRACES is an online portal established by the Income Tax Department. What is Form 26AS?įorm 26AS is a statement that fulfils the following purposes:Ī) A document that maintains the record of the tax that you have paid while filing your Income Tax Returns.b) It acts a proof that TDS has been deducted and collected.c) Acts as a confirmation that the government has received the taxes.d) Helps you to match and verify actual transactions with the ones recorded. From June 2020, 26AS also includes information regarding specified financial transactions.

You can only access the tax credit statement with a valid PAN card. It is a document that contains various tax-related information such as the following:Ī) Tax deducted on the income earned by youb) Advance tax paid c) Tax paid by self-assessmentd) Tax refunds received by you This document becomes handy when you file your income tax returns. This form contains the details of all TDS deductions from your income in the previous year. Form 26 is an important annual tax-credit statement.

0 kommentar(er)

0 kommentar(er)